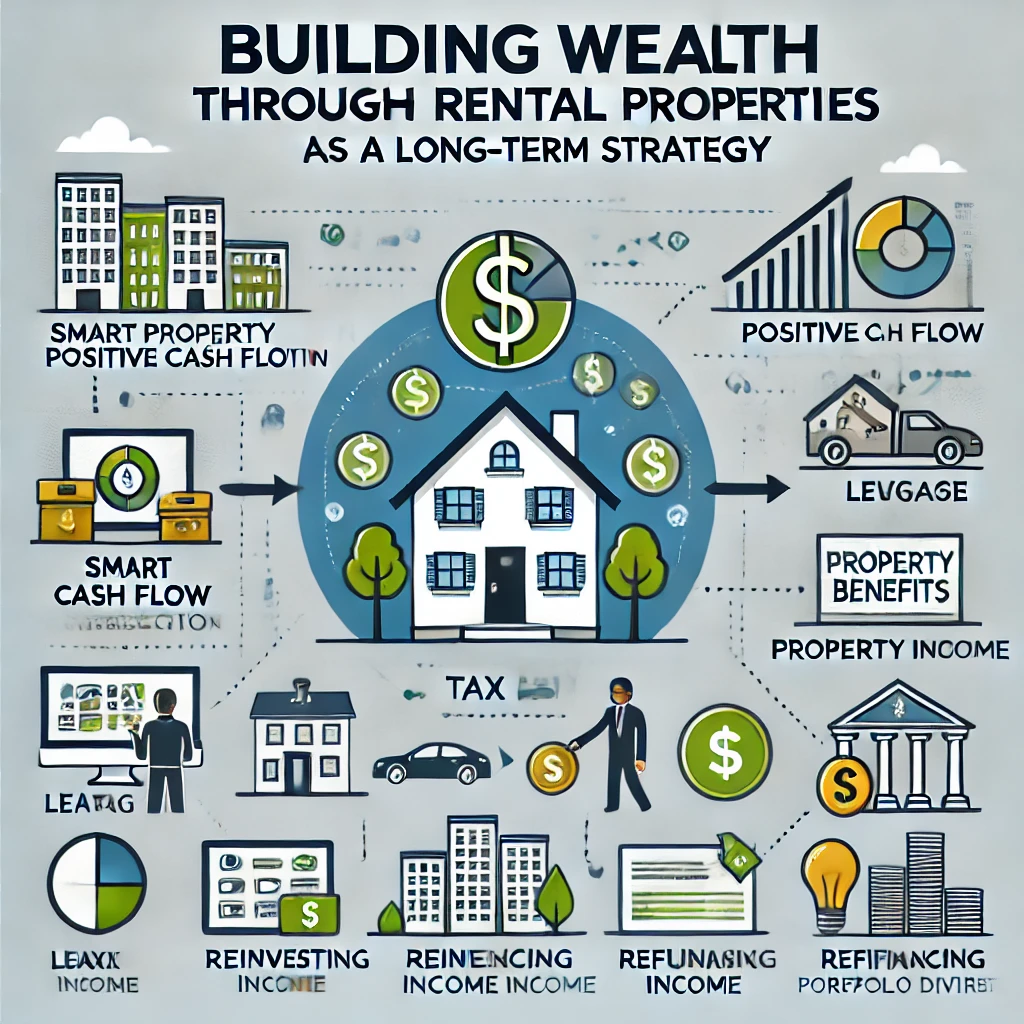

Investing in rental properties is a proven way to build wealth over time. With a strategic approach, rental properties can generate steady cash flow, appreciate in value, and provide significant tax benefits. Here’s a guide to help you get started with a long-term wealth-building strategy through rental property investment.

The key to successful rental investing is choosing the right property in the right location. Look for properties in areas with high rental demand, strong job markets, and good schools to attract reliable tenants.

Tips for Selecting Properties:

Why It Matters: Choosing the right property maximizes rental income potential and ensures your investment holds or grows in value over time.

A rental property’s cash flow is the difference between rental income and all expenses. Positive cash flow means you’re generating income each month after covering mortgage payments, maintenance, and other costs.

How to Maximize Cash Flow:

Why It Matters: Positive cash flow provides income while also helping cover unexpected expenses, contributing to the long-term profitability of your investment.

Leverage, or using borrowed money to finance a property, can significantly enhance returns if managed carefully. By putting a smaller down payment on a property, you can control a larger asset and potentially see greater returns.

Best Practices for Leverage:

Why It Matters: Leverage allows you to build wealth with less upfront capital, but using it wisely protects you from potential financial setbacks.

Real estate tends to appreciate over time, making it a powerful tool for wealth-building. While market fluctuations may impact short-term gains, properties in stable or growing markets typically increase in value long term.

Factors That Drive Appreciation:

Why It Matters: Appreciation builds equity over time, which can be tapped into through refinancing or property sales to further invest or pay off debt.

One of the most effective strategies for building wealth through rental properties is reinvesting the income generated from your properties. Reinvesting allows you to grow your portfolio and increase overall cash flow.

Ways to Reinvest:

Why It Matters: Reinvesting income maximizes the compounding effect of your investments, leading to faster growth of your rental portfolio.

Real estate investing comes with various tax benefits that can enhance profitability. From depreciation deductions to tax-free refinancing, understanding and utilizing these benefits can increase your overall returns.

Tax Benefits to Consider:

Why It Matters: Leveraging tax benefits lowers your tax burden, improving cash flow and enabling you to reinvest savings back into your portfolio.

A reliable property management team can handle day-to-day operations, such as maintenance and tenant relations, allowing you to focus on strategic growth. This is particularly beneficial as you scale your portfolio.

Benefits of Property Management:

Why It Matters: Property managers help maximize rental income, minimize vacancy rates, and improve tenant satisfaction, contributing to long-term success.

Over time, as you pay down the mortgage and the property appreciates, you build equity in your property. Refinancing allows you to access this equity, which can be reinvested in other properties.

Refinancing Strategies:

Why It Matters: Accessing equity without selling the property helps you expand your portfolio and increase income without capital gains tax.

Real estate markets can fluctuate, but focusing on long-term goals helps you weather these cycles. Patience and a well-planned strategy enable you to benefit from both appreciation and cash flow over time.

Strategies for a Long-Term Perspective:

Why It Matters: Staying focused on long-term goals helps you navigate market cycles confidently, ensuring steady growth in wealth over time.

Diversifying your portfolio reduces risk by spreading investments across different property types or locations. A balanced portfolio can protect you from market-specific downturns and create multiple income streams.

Ways to Diversify:

Why It Matters: A diversified portfolio mitigates risk and increases resilience, ensuring consistent cash flow and growth.

Building wealth through rental properties requires patience, careful planning, and a commitment to long-term strategy. By selecting the right properties, maximizing cash flow, leveraging tax benefits, and reinvesting profits, you can create a sustainable, profitable rental portfolio that grows over time.

At SMAdvice Realty, where vision meets opportunity, we support investors in navigating the rental property landscape and building lasting wealth. Ready to start or expand your rental investment journey? Contact us for expert guidance tailored to your goals.